South Africa’s townships are not only vibrant communities but also thriving economies worth close to R900 billion and home to nearly half of the country’s urban population. For financial advisers, the opportunity is immense, particularly in the funeral market.

Funeral cover remains a top financial priority for township residents, with most already insured through parlours, stokvels or insurers. Yet millions remain without cover even as many unemployed residents consider it a monthly essential. This shows how deeply important funeral cover is in these markets and why advisers who are visible, trusted and offer simple, flexible products can succeed.

Kobus Wentzel, Group Distribution Executive at 1Life Insurance and Clientèle, shares his insights into township economies and how advisers can identify opportunities that help residents protect their families and strengthen financial confidence.

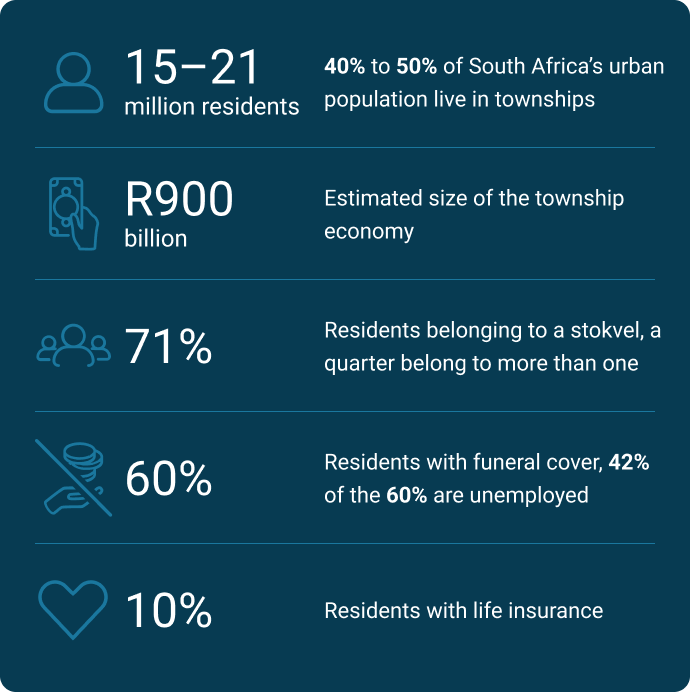

5 township facts you need to know

South Africa’s townships are growing economies, with many small and informal businesses catering to the needs of millions of residents.

(Sources listed below)

Where is the opportunity?

There are many opportunities for insurance and savings products that help residents manage expenses and protect against financial shocks.

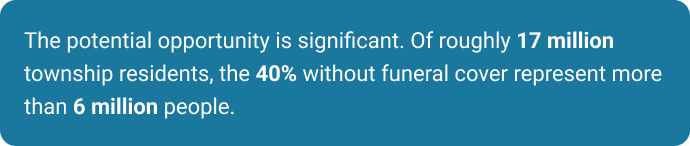

Funeral cover

60% of residents have funeral cover and funeral stokvels are only second in size to grocery stokvels, with 30% of residents belonging to one.

Funeral parlours are strong competitors, with 30% of residents buying their cover from them because they are accessible and community-based. However, a further 33% took out funeral cover through an adviser, insurance company or bank.

Think that’s too high given the country’s unemployment problems? Think again — the 2025 TCX report shows that 42% of township residents with funeral cover are unemployed. This is how important funeral cover is in these markets and represents a real opportunity for advisers with visibility in the township and flexible, easy-to-understand products.

“Funeral arrangements remain a significant financial burden, shaping saving and insurance behaviour in townships…. insurers who intentionally show up in townships through branches, advisers or community initiatives are better placed to build resilience and financial confidence.” 2025 TCX report

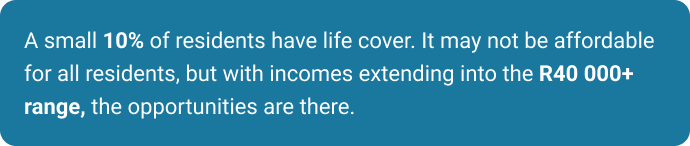

Life insurance

Life cover provides a cushion for families and extended families who rely on an income earner and ensures expenses can be met if that person passes away.

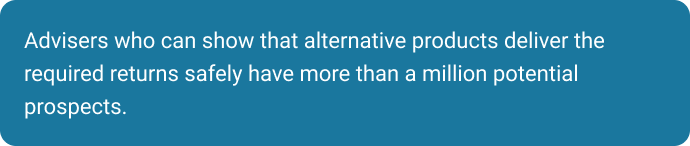

Savings

Half of the township income may be spent on food, but the need for and interest in financial products is high.

Retirement savings don’t feature prominently in township studies, so retirement annuities and other long-term savings might be a hard sell. But with 45% of residents actively saving for emergencies and a further 33% for school needs, financial products that meet these financial needs will be in demand. Currently, 54% of savings are with banks and 29% are in cash at home.

Two trends to pay attention to

The key to a successful kasi (township) business is:

- Keep it local to build trust in the community

- Have a social media presence

These two trends are key for financial services as well: keep it local and relevant to residents so you can build trust and embrace social media.

Liking local

The 2024 Rogerwilco Township Customer Experience (TCX) report found that township residents prefer local retailers that show they understand their needs and support them. Price will always matter, but an impressive 62% of consumers said they remembered the retail brands that “showed up in difficult times and support their communities.”

When it comes to financial products, TCX 2025 found that local is also preferred, with nearly a third of residents buying funeral cover from funeral parlours.

Not on social media. Not trustworthy

The 2024 TCX report also found that digital engagement is the “backbone of community resilience and brand discovery.” Eighty-five percent of township residents trust social media for product discovery. If you are not active online, trust quickly declines. Master the medium and grow your business.

It’s different, but the same

Businesses that succeed in townships do so by understanding the community and their needs and building relationships based on support and transparency. This is the very core of what a financial adviser does every day. Build loyalty and business is sure to come. Trust may be low at first, but take small steps every day and it will grow, creating real opportunities for your business.

Sources for township facts:

- SME South Africa: A guide to South African township economy

- 27/Four Investment Managers: The township economy report September 2025

- Rogerwilco 2025 Township CX report

Read more about the township economy

Understanding and respecting the township economy

Inclusive economic growth, building sustainable township economies