There’s no denying that 2020 has been an unusually difficult year. Most families’ finances are under pressure and you may be wondering how you can afford the essential items in your budget. Now more than ever, as the nation battles the COVID-19 pandemic, you need to hold on to your life cover so that your family is covered should anything happen to you. Have a look at our 8 ideas on how to free up funds to cover your monthly premiums.

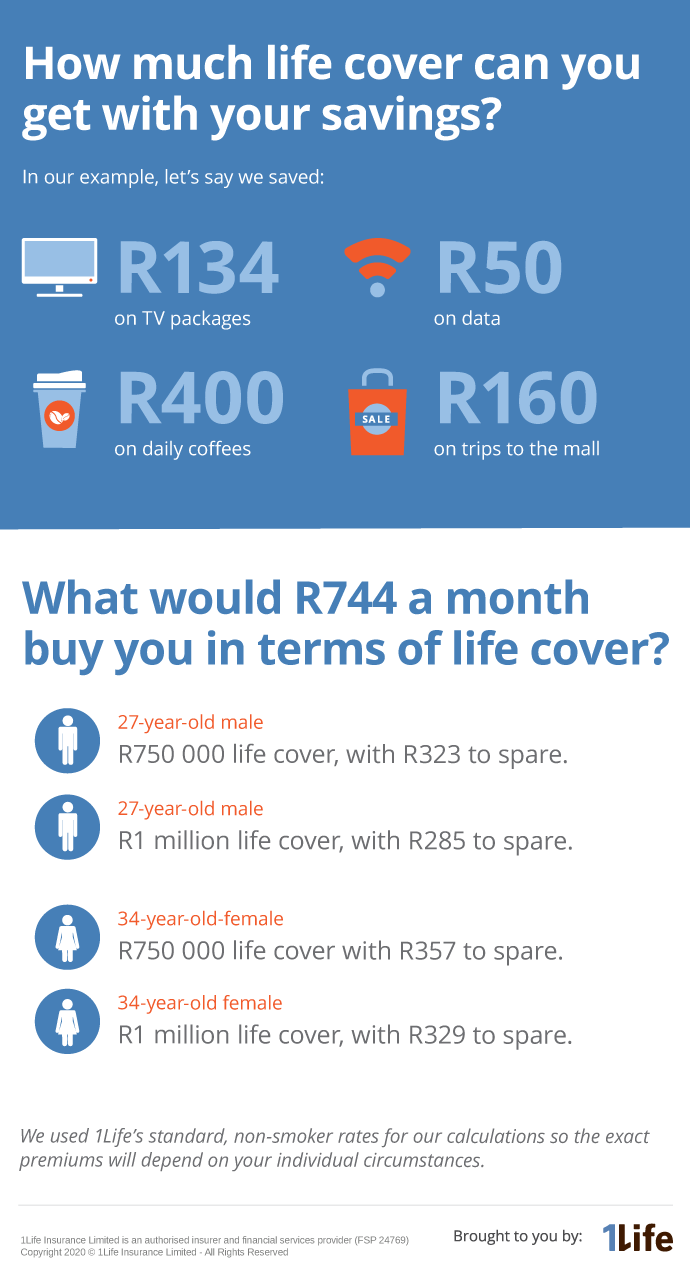

We compared potential savings to your monthly life premiums. We found that not only is life insurance affordable, with a few changes here and there, you can also free up even more money in your budget!

Look at where you spendWe looked at common items in a budget to find out how to save a few extra Rands. We’ve listed our top 8 ideas below and have even more at the end of the article. First off, to find out where you can save, analyse your spending. Record on an app or in a notebook what you spend each day, week and month. Note the amount, and what you spent it on. Then look at how you can reduce these expenses, if they are taking money away from important budget items such as insurance.

Change your entertainment package

You could save: +R130 a month

Okay, so this is not a new one, but some of us still have scope to reduce costs quite a lot by taking a cheaper TV package or opting for online streaming.

- Changing from DStv Premium to DStv Compact Plus saves R290

- Changing from DStv Compact Plus to DStv Compact saves R130

- Changing from DStv Compact to DStv Family saves R134

- Changing from DStv Premium to DStv Compact and adding Netflix saves R321

Still got a landline?

You could save: R300 a month

Unless you have poor cell reception or no mobile phone you are unlikely to need a landline. Landline packages vary but cancelling your landline could save as much as R300 a month.

Go for a cheap data and mobile package

You could save: +R50

Data prices have come down from 1 April 2020, so you should be able to get a much better deal. Do your research and compare prices and then go for a package that matches the amount of data you use.

Take a cheaper mobile phone

You could save: +R1 000 a month

The new smart phones may be very enticing, but unless you are using all their features there is room to take a cheaper model. The price differential could be in the thousands of Rands, and the features you need will still work well.

Ditch the daily café coffee

You could save: R400 a month

Coffees (and teas and bottled water) can cost around R25 a day, which adds up to R125 a week. Swop bought for home made on 4 of the 5 days and you save R100 a week or R400 a month.

And if you take packed lunch to work instead of buying you could save even more.

Form a lift club and save the costs of a tank of petrol

Form a lift club or work from home

You could save: +R500 a month

Drive your car to work for two weeks a month instead of four and you should save at least one tank of petrol. If you found that you could work from home quite productively during lockdown, ask your employer if you can continue working from home a couple of days a week - it will cut your transport costs, and save on commuting time.

Only shop weekly

You could save: +R160 a month

Have you added up the extras you pay every time you take a trip to the mall or shops? There are parking costs, car guard tipping, a bottled water or coffee to keep you hydrated. And then there’s the impulse buying that’s so hard to resist. Those costs add up, so limit trips to one a week and get everything done in that one trip.

If you cut out two trips a week, parking and car guard tipping costs alone you could save R40 a week.

Don’t let debit orders bounce

You could save: +R65 for each bounced debit order

If you are having a cash flow problem, rather than incurring the extra costs of a bounced debit order, let the business who has a debit order on your account know you cannot meet the debit order, preferably 7 days in advance. This way they can stop the debit order before it reaches your account.

It’s all about your family’s well-beingWhen you look at your budget and think about how to free up funds, remember to include your family in your discussions. Speak to them about how important some budget items like life insurance are and encourage them to come up with their own savings tips. You might all have to make sacrifices, but you will have the peace of mind of knowing that your loved ones will have financial security if you are no longer around.