Sometimes insurance claims won’t be paid - either because the event took place in a waiting period, or because a particular event is excluded from your policy. As a policyholder, you don’t want any surprises! Know your policy, its exclusions and waiting periods, so you can be sure you are covered, and your claim will be paid. Read on for our simple guide to all you need to know.

What are policy exclusions

An exclusion on a policy means that if something happens directly or indirectly as a result of an excluded event, a claim won’t be paid. For example, crime is an excluded event, so if you are killed while taking part in a criminal activity such as hijacking or burglary, the claim on your life and/or funeral policy will be rejected.

There are two kinds of exclusions:

- General exclusions apply to all similar policies, such as all life policies

- Specific exclusions apply only to your policy.

General exclusions

These most often apply when a life assured or member harms themselves, either deliberately, or by doing something dangerous or illegal.

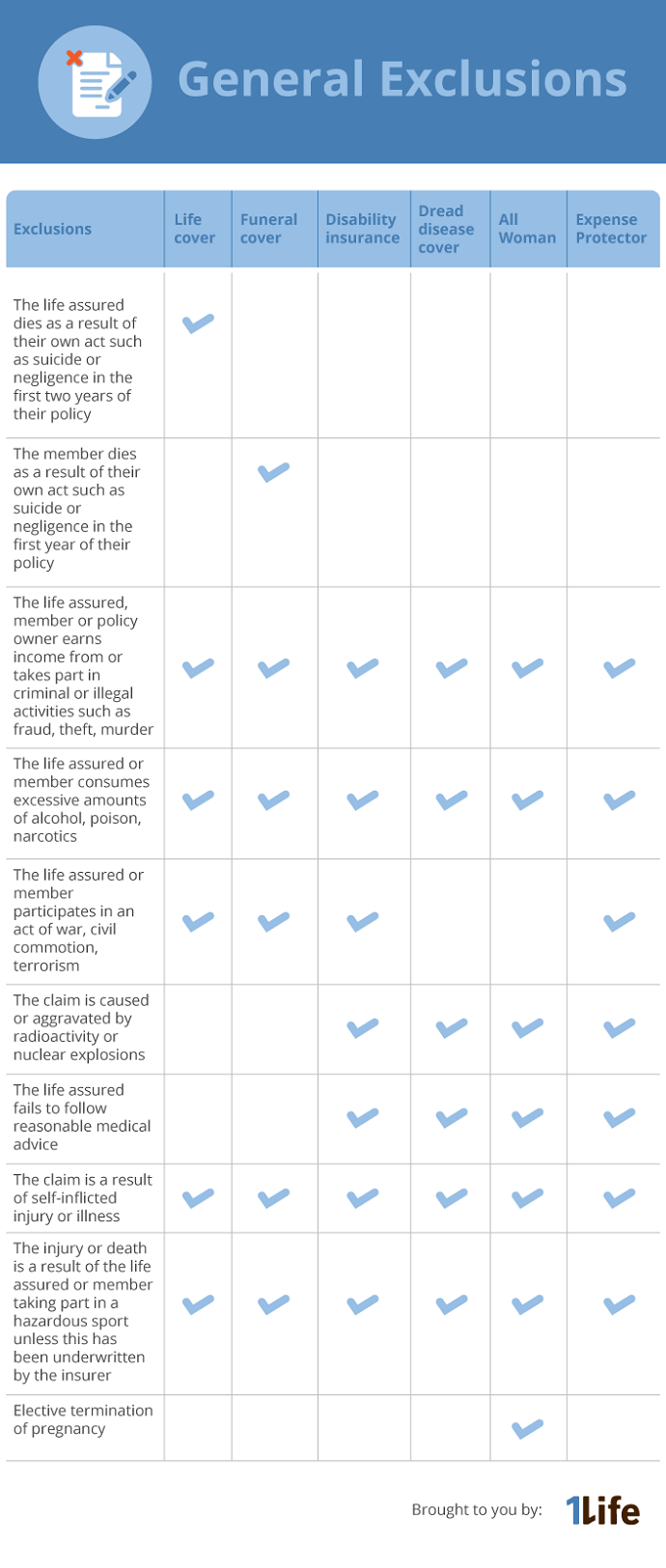

This table shows the exclusion and which policies they apply to.

Note: Various dread diseases such as cancer and heart attacks have additional exclusions that you can find in your 1Life policy book.

It’s also important to know that 1Life will only consider a dread disease claim 28 days from the date that it was diagnosed. This is known as the survival period - which is how long you need to survive a diagnosis before a claim will be considered.

Specific exclusions

A specific exclusion may be applied to your life, dread disease, All Woman™, disability or Expense Protector policy, based on your personal health and lifestyle information.

Specific exclusions usually fall into health, activity or travel categories.

Health: If you have a pre-existing condition, any illness or event relating to that condition may be excluded from certain benefits on your policy, such as disability cover. For example, if you have a spinal problem when you take out a life policy with disability cover, the spinal problem may be excluded from disability cover, and any claims for disability benefits that relate to the excluded spinal problem will be rejected.

Activity: If you regularly take part in risky activities such as cliff jumping, your insurer may exclude claims as a result of this activity.

Travel: Travel to certain countries may be excluded, and you may not be covered while travelling or residing in a specific country. For example, a country where there is a civil war would have a high “territorial risk”, as there would be a higher risk of injury and death.

Should you travel for more than 14 days outside of South Africa, tell your insurer where you are going to confirm if you will be covered.

If a specific exclusion is applied on our policy, you will be notified and asked to accept this condition when you take out the policy. Specific exclusions can be reviewed, so if you stop taking part in dangerous activities or your health improves you can apply to have the exclusion removed. However, during a review the policy may be underwritten again and the terms and conditions may change, for example the premiums may change.

You can find details of any specific exclusions in your policy schedule.

What are waiting periods

A waiting period is the time between taking out a policy and the time in which you can claim on the policy. For example, a funeral policy would have a six-month waiting period for claims due to natural causes. You cannot claim for a death that occurs as a result of a natural cause, such as a heart attack, during that six-month period.

You can find details of waiting periods in your policy schedule.

What happens when your policy changes?

If you increase your cover on any 1Life policy or add a member to a funeral policy, the exclusions and waiting periods that applied when you first took out the policy apply to the new cover and member from the effective date of the change to your policy.

So, if you add a member to a funeral policy you have had for two years, the new member cannot claim for the first six months from the time they are covered on the policy.

If your policy was cancelled because premiums weren’t paid, and is reinstated, the exclusions and waiting periods apply from the date of reinstatement. Your insurer will tell you what you need to do to reinstate a policy and what terms and conditions apply. You can read more about reinstating a policy.

Take time to understand your policy

Long term insurance products provide for your loved ones when you cannot. The terms and conditions on insurance policies affect claims, so it’s worth taking the time to go through your policy and make sure you understand what it covers and how and when you can claim.

Posted September 11, 2018

Updated May 6, 2021