As of 1 March 2024, the Ombudsman for Long-term Insurance amalgamated with all other Ombudsman to form the National Financial Ombud Scheme South Africa NPC (the NFO). The Life Insurance Division of the NFO will continue to operate from its current premises in Claremont, Cape Town, whilst the other divisions will primarily operate from the premises in Johannesburg. Both offices will receive walk-in complaints.

What does this mean to financial advisers and their clients?

1. Financial Advisers have six months from 1 March 2024 to update any communication given to their clients that refers to the Ombudsman for Long-Term Insurance.

National Financial Ombud Scheme South Africa (the NFO)

Tel: 0860 800 900

Email: [email protected]

Website: www.nfosa.co.za

All existing communication channels will still be available and automatically routed to the NFO for at least the following six months.

2. Financial Advisers need to ensure that they communicate who the NFO is to their clients and remember the FAIS Ombud does not form part of the NFO. The NFO is only the banking, credit, long-term insurance, and short-term insurance ombuds.

3. Financial Advisers can communicate the following walk-in addresses to their clients:

Head Office, Postal Address and Johannesburg Physical Address: 110 Oxford Road, Houghton Estate, Illovo, Johannesburg, 2198

Cape Town Physical Address: Claremont Central Building, 6th Floor, 6 Vineyard Road, Claremont, 7708

4. Financial advisers and their clients have one central complaints point for banking, credit, long term, and short-term insurance.

5. A party may submit a complaint orally or in writing to the NFO either by using the NFO's online complaint form, submitting the complaint by email, facsimile, or post, or contacting the NFO by telephone or other electronic means or in person.

6. The NFO scheme has rules that financial advisers should familiarise themselves with, read more here.

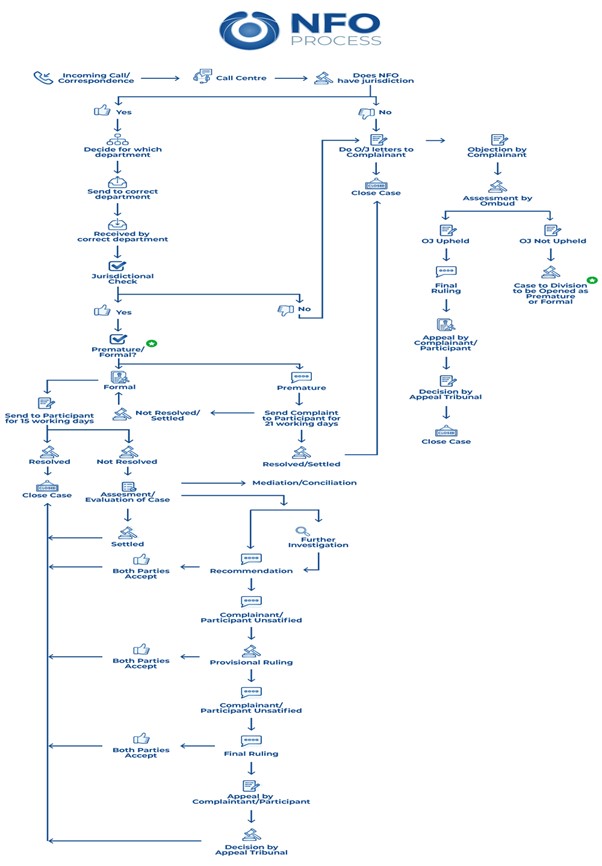

7. Financial Advisers should manage their clients’ expectations that the process as below has changed to review and finalise complaints.

8. The flowchart below shows the stages of the complaints resolution procedure and how it works in practice once it is initiated, including some of the timeframes involved.

The information contained in this article was correct at date of publication