Uncertainty isn’t new, but right now it feels relentless – from tariffs and geopolitical tensions to recession fears. For clients, the temptation is to sit on the sidelines or make knee-jerk decisions. For advisers, the challenge is to cut through the noise and keep them on track. The experts agree that success in times like these comes down to four golden rules, says Kobus Wentzel, Group Distribution Executive at 1Life Insurance and Clientèle.

The experts’ four golden rules for investing when there is uncertainty

So far, this year has felt unlike any other in investment markets with extreme volatility and geopolitical events weighing on investor sentiment. It’s a tough climate for investors who are inundated with bad news headlines on a regular basis. Some may have cold feet and want to wait to invest while others prefer to take a low-risk approach with all their investments – despite having goals that require above-inflation returns. Are these appropriate investment strategies?

We checked in with local and international asset managers as well as financial planning experts who shared their golden rules for investing:

- Invest according to a financial plan: follow the plan, not the market

- Invest and stay invested: if you are not in the market you will not get the returns you need

- Don’t overreact to market news: sell on sentiment or a headline and you are likely to lock in losses and miss out on subsequent growth

- Diversify: big bets are off

Here’s how you can help your clients follow these golden rules.

Encourage clients to stick to their financial plan

A client’s financial plan lays out their goals and the investments and strategies that will give them the best chance of achieving their goals. You need to take life stage and time horizons into account, such as retirement dates, as these can influence the make-up of an investment portfolio – especially diversification (see below).

If goals have changed, adapt the financial plan. But if the markets have changed, stick to the financial plan. As Nick Murray, author and financial services professional, says in a recent Morningstar podcast “keep working the plan.”

Ensure clients invest and stay invested

Clients may want to avoid risk and keep cash, but the cost of this is not achieving their financial goals.

Invest unless the return requirement is 0%

Advisers can help clients understand that they need a return on investment to achieve their goals and the only way to achieve this is to invest in markets. This will involve a degree of risk. In the short term there is likely to be volatility and, in some cases, adverse market moves. These are most likely to smooth out in the long term. It is only an investor who requires a 0% return who can consider avoiding risk assets. For the rest, the maxim applies: if you are not invested you will miss out.

“Eliminating risk also reduces the ability to generate superior long-term returns,” notes Allan Gray’s COO Mahesh Cooper in their July 2025 Quarterly Commentary.

Stay invested to achieve required returns

Staying invested is also critical. This most often involves ensuring clients don’t sell when markets fall or try to time an entry point.

Sell when markets are low, and you lock in losses. Try to time the markets, and you reduce investment returns if you miss the best days, which is more likely than not. A 2024 JP Morgan study found that missing the best days can reduce investment returns by as much as 4%.

To help clients stay invested, share investment and market news that show reasons why this will be to their advantage:

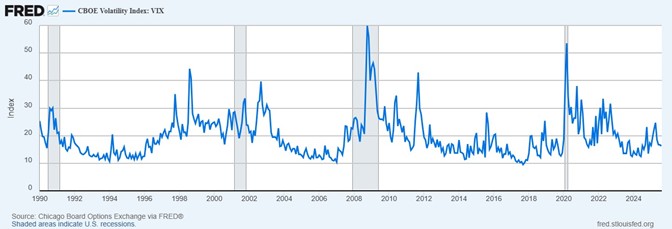

- There has been higher volatility in recent years (see chart below) and volatility doesn’t mean low returns. “Historically, periods of uncertainty have often laid the groundwork for future opportunity – provided investors stay the course,” say PortfolioMetrix in their June 2025 Quarterly Insights South Africa

- Investment returns have been good with SA equities returning 23.2% for 1 year and 16.4% over 5 years, global equities 15.5% over 1 year and 15.7% over 5 years, as shown in the Corion Capital July 2025 report, available by subscription here

- Markets and businesses are resilient. They adapt to changing conditions and continue doing business and serving customers in new and old markets with new and old products and services. “Businesses around the world will adapt as they always do,” says Izak Odendaal of Old Mutual Wealth.

Volatility index (VIX) since 1990

Ensure appropriate diversification

Each client has unique goals and the diversification of their portfolio must reflect these.

Diversification needs to:

- Be across regions and asset classes, for some even including “alternative” assets such as gold, private equity and crypto assets in their portfolio.

- Take time horizons into account, such as when an investor is retiring.

- Be reviewed regularly throughout the year to make sure clients are not invested in different funds that have different names but are similar. This is a step worth spending time on, especially when there is uncertainty, because it can mean the difference between losing capital and avoiding capital losses.

“This is not a time for overreaction or outsized thematic bets,” say PortfolioMetrix. “Instead, it’s a moment to stay focused on the basics: robust diversification, composure in the face of noise and a long-term mindset.”

Stay close to your investment managers and DFMs

Your clients, and you, will have investment questions only a professional asset manager and/or DFM can answer. This doesn’t mean they can provide certainty and guarantees, but they can tell you how they are managing money in uncertain times. This can help you decide which approach and fund or investment is most appropriate for your client.

Ask investment managers and DFMs relevant questions such as:

- How are your funds positioned for growth and to protect against capital loss?

- Where are you seeing opportunities – which volatility always brings?

- What drawdowns and rebounds have your funds experienced?

- Do ETFs give adequate exposure and protection against losses?

And finally, share investment views and news with clients who are interested. You can curate your own content, give a summary of available content and share investment managers’ full reports and links to podcasts. These will help your clients understand more about investing in uncertainty and show that you are actively looking out for them.

The future is uncertain – but it always has been

It’s different, but it isn’t. The investment world may not have seen tariffs like we have in 2025, but it has seen other shocks and setbacks, and it will again. Your role as an adviser is to make sure your clients have a realistic financial plan that reflects their needs and circumstances, and help them achieve their goals in whatever investment climate persists.