If you’ve got an unpaid debt to a registered credit provider, the person or company you owe money to can approach a Magistrate’s Court to obtain a garnishee order. The garnishee order (also known as an emoluments attachment order, or EAO for short) allows money to be deducted from your salary and paid to the creditor directly to clear the debt or pay maintenance.

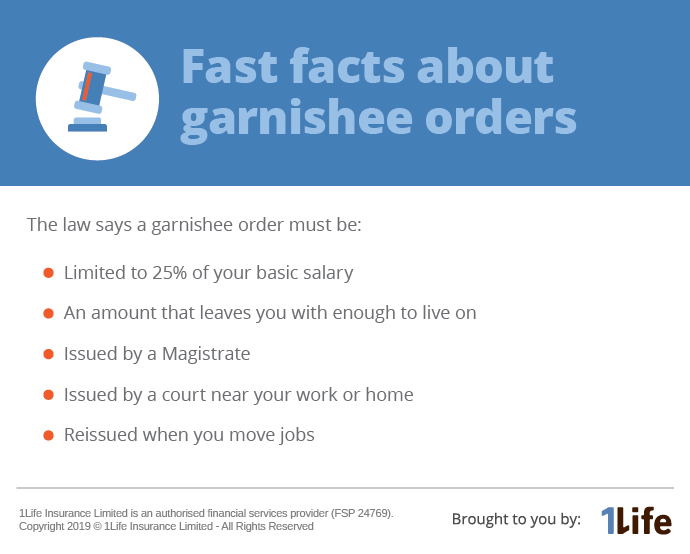

It’s quite scary to think that you may have these amounts going off your salary. There are some laws around garnishee orders that protect you to make sure you aren’t left with no salary. Here are four important things to know about garnishee orders.

A garnishee order must be issued by a magistrate in a court near where you work or live and you must be asked to appear in court

The reason for this is to give you an opportunity to show whether or not the debt is legal and how much you can afford to pay from your salary to clear the debt.

In the past, it was easy for a creditor to obtain a garnishee order that wasn’t fair to the debtor. Creditors would sometimes apply for garnishee orders in a court far away, so the debtor had very little chance of presenting their case. That is no longer permitted. If the court is far from you the garnishee order cannot be granted. In addition, you must be told of the court date and when you can appear.

Previously, orders could be issued by the clerk of the court. The law is now stricter and only magistrates can issue garnishee orders.

Related posts

A garnishee order is limited to 25% of your salary and must leave you with enough salary to live on

You may have heard of stories where garnishee orders were so high that there was little, or no salary left after they had been deducted. Last year a new law was passed to makes sure this situation doesn’t happen.

This law says that a maximum of 25% of your gross salary can be deducted for a garnishee order. Your gross salary is what you earn before deductions but does not include allowances such as a housing allowance or any overtime.

Furthermore, the deduction of the garnishee cannot leave you with too little income – you must be able to live and work on the remaining salary.

If your garnishee order is higher than 25% or you are struggling to survive on your salary, you can approach the Magistrate’s Court that issued it to change it. You will need details of your income and expenses. You can find details of the court on your garnishee order.

You may have to pay some costs, but the total charges cannot be higher than the debt

There are legal costs, and sometimes commission to a debt collector, associated with garnishee orders but these cannot in total be more than the debt itself. For example, if your debt is R3 000 and the charges are R4 000, the maximum you can be charged is R3 000.

If you leave your employer and start a new job you need to inform the court and a new garnishee order will be issued to the new employer

The garnishee order is valid for your existing employer. A new garnishee order is required in the name of your new employer, instructing them to deduct the amount owing.

The bottom line

Garnishee orders are only used by creditors as a last resort to make sure you pay your debt. Always check your garnishee order to make sure it is valid and check your statements so you know when the debt will be paid, and the garnishee order lifted.