A personal loan can help fund the important things in life, if managed carefully. But of course, you and your credit provider need to know that you can pay back the loan. Here’s how lenders assess and approve personal loans.

Your credit provider uses the information in your personal loan application and the credit information on your credit record to assess your loan application. Using this information, they determine if you can afford the loan, which means whether you can and will repay the loan amount plus interest and any charges when the amounts are due.

A credit provider is any person or business who lends money and charges interest and is registered with the National Credit Regulator. It is best to take a loan from a registered credit provider.

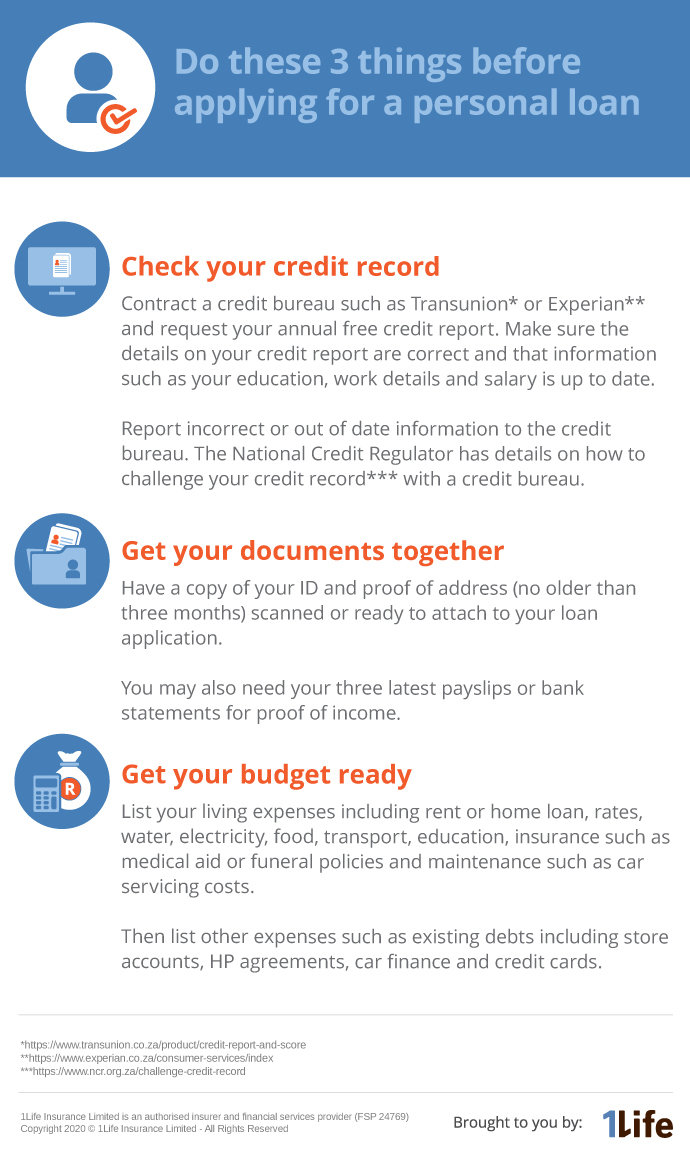

Information needed to assess your loanHere’s the information you must give to your credit provider when applying for a loan:

- Name

- ID number

- Address

- Contact details

- Income

- Expenses

- Other personal information such as education and work history

Top tip: Make sure the information you give in your loan application is accurate, honest and complete. In other words – the whole truth!

Assessing loansThe key thing your credit provider wants to know is if you can afford the loan and if you will repay it on time. To check this, they look closely at:

Income and expenses

If your income is greater than your expenses, it means you have some spare cash in your budget which could be used to repay the loan. A credit provider would likely approve this loan application.

However, if your expenses are higher than your income, it will be difficult to repay a loan. In this case a credit provider may decide to not approve a loan.

Total debt

The amount of debt you have is also important. If, for example, you have a home loan, vehicle finance, credit card, three store accounts, two hire purchase agreements and a stokvel loan, you may find your debts exceed the value of your assets and your annual income. Taking on more debt may put you in a situation where you cannot repay your debts and you have to go into debt review.

Applying for more credit when you have a lot of debt is a warning sign to credit providers that you are struggling to repay current debts. In this case, taking on more debt would just be making the situation worse. Granting a loan in these cases is known as reckless lending and is illegal in terms of the National Credit Act.

Credit record

In addition to the above, when assessing loan applications, credit providers look at your credit record which they obtain from a credit bureau. Your credit record shows your debt repayment history for the last five years, how much debt you have, your credit applications and enquiries about your credit record from credit providers, and if you have any legal proceedings relating to debt on your record.

Credit bureaus typically score credit behaviour (whether you pay on time, for example) and allocate a credit score. According to the TransUnion website, a credit score ranges from 0 – 999. High scores, above 600, indicate a better credit risk (you are likely to repay the loan) whereas low scores show there is a higher risk of you not repaying your loan. This could be because you have too much debt or have struggled to pay debts in the past. Your credit provider will use this information when they assess whether or not you can afford a loan.

Credit bureaus keep payment information on your record for five years, so although you can improve your credit score by paying in full and on time, your past credit management does impact your current rating.

Your credit provider looks at all these things together to assess your application. They may also obtain information from other sources such as your bank or SARS. Based on this information, they will decide to approve, or not approve, your loan application.

Once approved it’s a quick processThe loan approval process can be as quick as 15 minutes, so once you’ve applied and given your information you could be granted a loan within the hour. And have the money in your bank account on the same day.

Tell the whole truth in your loan application

Credit providers are very thorough when they assess loan applications. Be as thorough when you apply for a loan. And when you are granted a loan make sure you understand all the terms and conditions. Reputable credit providers will explain this to you.

It’s all about affordabilityRemember that your credit provider wants to grant loans to people who can and will repay them. Make sure you give correct information and that when your loan is granted, you repay as per the schedule. This will go on your credit record and be used to show future credit providers you manage your debt well.