It’s never a good idea to take on unnecessary debt, but sometimes, there’s just no way you’ll make it to the end of the month without a little something to tide you over. If you do need to borrow money, make sure you are borrowing from a reputable lender so that you don’t find yourself in even more trouble next month.

Here are the questions that you should ask yourself and your credit provider to make sure that you only borrow what you need to, and that you are being treated fairly.

Ask yourself these questions before you take a small loan

Is there any alternative to taking out this loan?

- Do you really need it, or can you wait until the end of the month?

Have I tried to get credit at a better interest rate elsewhere?

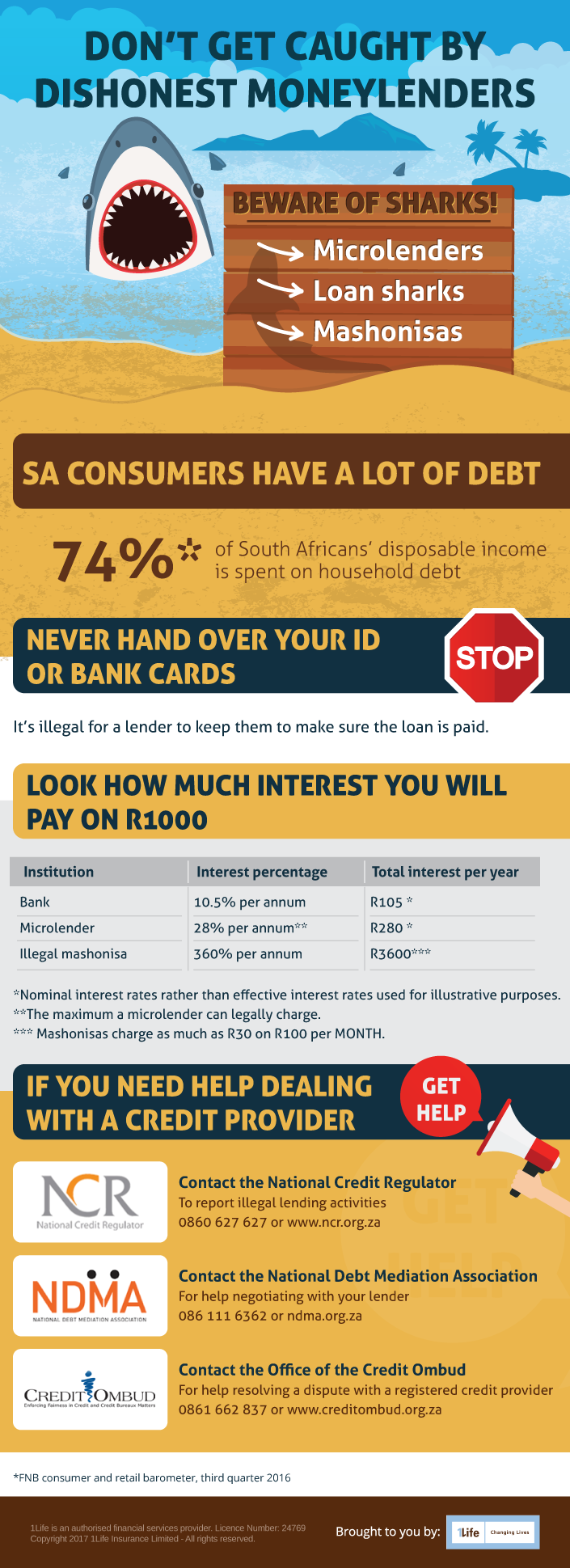

- Banks almost always offer a better rate than a microlender or mashonisa.

Can I afford the repayments?

- Be honest with yourself. If you need a loan this month, will it be impossible to afford the repayments next month?

What is the smallest amount I can borrow?

- If you have to take out a personal loan for food or transport costs, calculate the minimum you can borrow to survive. Don’t take whatever the lender offers you.

Ask your loan provider these questions

Are you registered with the National Credit Regulator (NCR)?

- All lenders, no matter what their size, are required to be registered with the NCR.

- An unregistered credit provider may not treat you fairly.

What is the interest rate?

- The maximum interest rate for unsecured lending in South Africa is 28% per year.

- Illegal lenders or “mashonisas” often charge far more.

Are there any other fees and charges?

- The maximum initiation fee for unsecured credit is R165 plus 10% of the amount over R1 000. The maximum initiation charge allowed is R1 050.

How much must I repay in total and over what period?

- Make sure that you know what your monthly loan repayment is, including the interest, and for how many months.

What must I sign, and can I have a copy?

- Always get a copy of your agreement in writing.

Will you perform an affordability assessment?

- Any lender should perform an assessment to ensure that you can afford to pay back the instalments. If this has not been done, the granting of credit is illegal.