There are a number of different ways to look at your financial situation and see how you are faring over time. One of them is to consider your net worth. In this blog, we look at why it’s a useful measurement, and how to work it out.

Why you should know your net worth

Your net worth is a snapshot of your financial health. It’s an important number to know because it shows if your finances are in good shape, or in need of some attention. It’s also the number your bank will need if you apply for a loan. In addition, SARS requires taxpayers to list their assets on annual tax returns, so they can calculate capital gains tax (CGT) - a tax on part of the profit you make when you sell your assets.

And if you’re wondering how much life insurance to take out, your net worth is one of the numbers you need to look at because it shows the amount your dependants would be left with if you passed away today.

Working out what you’re worth is fairly straightforward. You value (on the same date) your assets and liabilities, and subtract your liabilities from your assets, giving you your net worth.

Assets - liabilities = net worth

There are a few details you need to keep in mind when you value your assets and liabilities. Here’s our step-by-step guide to help you calculate your net worth.

How to calculate your net worth

1. Identify your assets

Assets are moveable and immoveable property. Some common examples would be:

- The house or property you own (or your part in it, if it’s shared)

- Investments such as endowments, shares, gold coins, unit trusts and exchange-traded funds (ETFs)

- Savings funds such as stokvels, fixed deposits, money market funds, retirement annuities, provident and pension funds

- Your car(s)

- Livestock

- Collectibles, such as a valuable painting or piece of jewellery

2. Value your assets

Assets should be valued at market value – the amount you would receive if you sold them today. Some assets are easier to value than others.

Shares, unit trusts, ETFs, fixed deposits and money market funds are easy – you can see the prices on companies’ websites and you should get a tax certificate showing the value every year. All retirement funds are also required to give you a statement showing value at retirement and death once a year. Use the value at death as this is the amount your beneficiaries would receive. Don’t forget to include any stokvel savings at the amount that would be paid to your family should you pass on.

Coins and collectibles can be a bit more difficult to value, particularly if they are rare. You can check websites such as eBay and auction houses for the market value of these assets.

Valuing your home, or any property you own, can also be tricky because two people may be prepared to pay a very different price for it. You can look at the prices properties in your area were sold for or ask an estate agent for a valuation. You can also use the municipal valuation as a guide if their numbers are realistic.

Cars are assets, but they lose value very quickly unless they are vintage collectible models. Check out how much your car is worth online, on sites such as Autotrader or Book Value of Cars.

To work out your livestock market value check on websites such as ngunicattle that list latest selling prices for Nguni cattle. But note that for tax purposes you’ll need to use the SARS standard rates that are very different to market value (+R12 000 for a cow versus R40 on SARS standard valuations).

3. Calculate your liabilities

Now you’ve got your assets sorted, you need to work out how much money you owe.

Your debt can be long term such as a home loan or short term such as an overdraft, personal loan, or loan from an informal lender. Don’t forget any outstanding debt on your car. Remember you’re looking for a snapshot of your wealth, so you need to list all your liabilities and any amount you owe that you need to repay. Include all card debt such as store accounts.

Home loan accounts, bank statements and store card statements will have the details of the total amount outstanding.

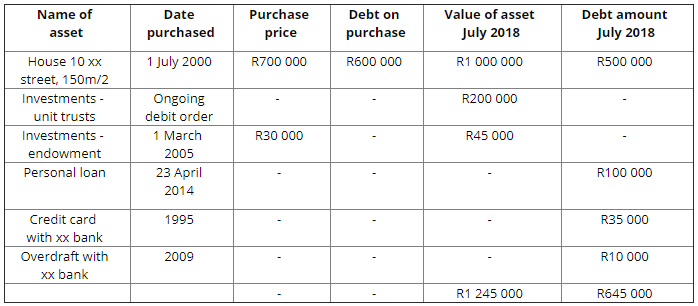

4. Draw up your balance sheet

Put your assets and liabilities into your balance sheet. Keep this balance sheet and update it each year, or when you buy, improve (for example, adding an extension to your home) or sell an asset, or pay off a debt.

5. Work out your net worth

Add up your assets and subtract your liabilities:

| Total assets | Total liabilities | Net worth |

| R1 245 000 | R645 000 | R600 000 |

Keep track of your net worth over time

Use the information you’ve gathered to track your finances. To increase your net worth, go through your income and expenses to see how you can increase the value of your assets and decrease your liabilities.

Don’t be disappointed or harsh with yourself – take as objective a view as you can and say this is my situation now, how do I want to change it?

Your financial advisor will be able to assist with this and offer guidance on how to improve your net wealth.